If you’re searching for heat pump rebates and tax credits in 2026, you’ve probably noticed that a lot of the information you’ll find online seems outdated or contradictory. The U.S. incentive landscape shifted significantly after December 31, 2025, when important federal tax credits for air-source heat pumps expired.

That doesn’t necessarily mean there aren’t incentives, but those incentives have transitioned from more generic federal backing toward state-administered rebates, utility incentives, and income-based electrification programs. Geothermal heat pumps, meanwhile, are on a separate federal incentive track that is unchanged.

This guide offers a transparent and concise overview of the incentives available in 2026, including eligibility criteria, program differences by state and household income, and practical strategies for homeowners to maximize savings without relying on previously expired programs or marketing hype.

In 2026, there are 3 primary types of incentives:

Knowing what category your home falls into is a fundamental first step towards selecting and installing any heat pump system. Homeowners evaluating modern, all-electric heating and cooling solutions, such as the systems outlined in VivaVolt’s heat pump overview, should first align their equipment choices with the incentive pathways that remain active in their state.

Section 25C: Energy Efficient Home Improvement Credit (Expired)

Federal tax credits of up to $2,000 for qualifying air-source heat pumps were previously available through the Section 25C Energy Efficient Home Improvement Credit, administered by the Internal Revenue Service.

Unless new federal legislation is passed, air-source heat pumps installed in 2026 are not eligible for a federal tax credit under Section 25C.

Geothermal heat pumps follow a separate incentive pathway under Section 25D, which remains active through 2032.

In 2026, geothermal systems are the sole qualifying heat pump technology for federal tax credits.

With the expiration of the federal air-source credit, the highest incentives now come via the state-administered rebate programs that are funded by the Inflation Reduction Act. These rebates are available at the point of sale, and they’re typically income-based.

HEEHRA: High-Efficiency Electric Home Rebate Act

HEEHRA is a federally funded framework that states may implement through programs such as Mass Save’s Moderate Income offerings. Access to HEEHRA-funded rebates is limited and typically available only through a select group of participating contractors. As such, HEEHRA is best understood as an informational incentive program, rather than a universally available rebate.

Eligibility and rebate levels

Additional eligible upgrades may include:

Important limitations

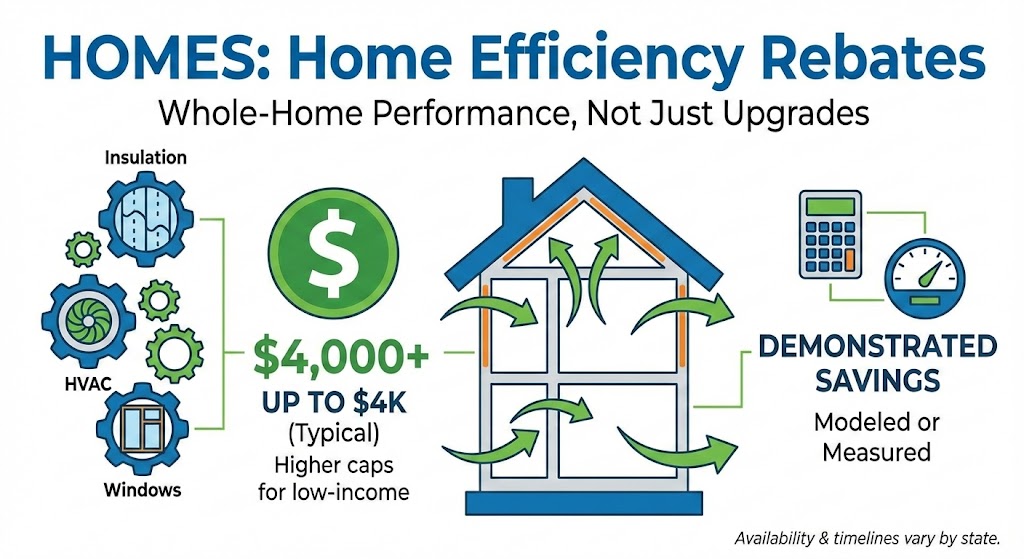

The HOMES program focuses on whole-home energy performance, rather than individual equipment upgrades.

HOMES rebates will vary widely depending on state implementation, energy modeling availability and timelines.

Beyond federal programs, most states and utilities offer state-funded or utility-provided heat pump rebates.

Examples include:

Most state and utility programs require pre-approval and the use of certified installers.

Federal credit (geothermal only)

Section 25D geothermal credit should be claimed using the instructions here:

State and Utility Rebates

For air-source heat pumps and electrification upgrades:

Homeowners may be able to confirm local programs via the ENERGY STAR Rebate Finder or the DSIRE.

| Incentive Type | Maximum Benefit | 2026 Status |

| Federal Tax Credit (25C – Air-Source) | $0 | Expired |

| Federal Tax Credit (25D – Geothermal) | 30% of total cost | Active |

| HEEHRA Rebates | Up to $8,000 | State-dependent |

| HOMES Rebates | $2,000–$8,000 | Rolling out |

| Utility Rebates | $500–$2,500 | Provider-specific |

Federal tax credits for air-source heat pumps expired after December 31, 2025. Systems installed in 2026 are not eligible under Section 25C. Geothermal heat pumps remain eligible for a 30% federal tax credit through 2032.

Most of the 2026 incentives come from state-administered rebates such as HEEHRA and HOMES, in addition to utility-specific programs. Depends on income level, state rollout, and funding availability.

Federal and state incentives cannot be combined on the same expenditure. However, tax credits for geothermal systems under Section 25D may be combined with some state and utility programs if the rules of the state/utility program allow it.

Eligibility is based on household income relative to Area Median Income (AMI). Households below 80% AMI may qualify for up to $8,000, while households between 80% and 150% AMI may qualify for up to $4,000, depending on state programs.

The ENERGY STAR Rebate Finder, the DSIRE database, and your state energy office or local utility provider are the reliable resources.

Incentives for a 2026 heat pump retrofit need a bit more planning, but a canny homeowner can still save a lot of money. Homeowners who understand the shift from federal tax credits to state-administered rebates can avoid costly mistakes and take advantage of programs that remain active..